CALB ranks the second-largest independent third-party electric vehicle (EV) battery producer in China. The company was founded in 2015 and it became the core battery supplier of GAC Group with its medium-nickel high-voltage ternary series products after a strategic business restructuring in 2018. In 2020, CALB witnessed large sales increases with GAC Aion's fast growth, thus making itself one of China's leading EV battery producers.

The following is a brief analysis of CALB's EV battery installations based on China's car insurance data.

CALB's installed power battery capacity reached 19.24 GWh in 2022 and ranked third in China with a market share of 6.53%, of which the installed capacity of ternary lithium batteries was 12.45 GWh, second only to CATL, and that of lithium iron phosphate (LFP) batteries ranked fourth at 6.79 GWh.

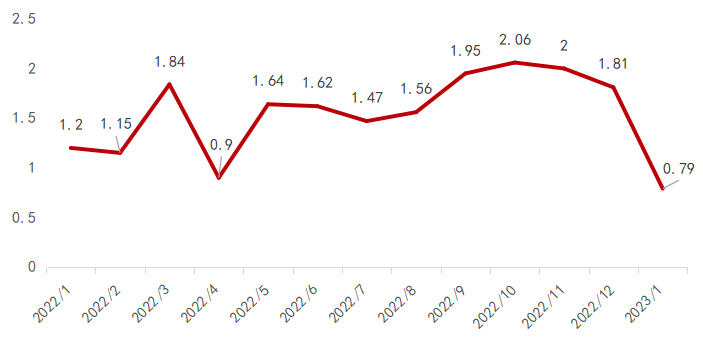

Figure 1-1: CALB's installed power battery capacity per month (Unit: GWh)

Sources: Compulsory traffic insurance, Mysteel

CALB has relied less on big customers by gradually diversifying its customer base.

According to the compulsory traffic insurance data, CALB's installed power battery capacity supplying GAC Motor reached 364.1 MWh in December 2022, with a month-on-month growth of 5.2%, accounting for a dominant 32.2% of the company's total installed capacity. And that supplying Geely Auto came in second at 335.5 MWh, surging 129.5% month on month. The installed capacity for Xpeng, Leapmotor and DPCA placed third, fourth and fifth respectively. CALB's installed power battery capacity for the five companies all exceeded 90 MWh in December. GAC Motor remained CALB's top customer in 2022, but the proportion of CALB's battery installations for GAC Motor had declined from more than 50% in 2021 to around 32% in 2022. CALB continues expanding its customer base rapidly and has become the core supplier for several car makers. Mysteel has learned that the penetration rates of CALB's batteries in both Xpeng and Leapmotor were close to 50% in 2022. With a diversified customer base, CALB becomes less reliant on big customers and has more bargaining power in the market.

Table 1-1: CALB's battery installations for car makers

|

Car Maker |

GAC Motor |

Geely Auto |

Xpeng |

Leapmotor |

DPCA |

Others |

Total |

|

In Dec. (MWh) |

364.1 |

335.5 |

171.6 |

117.9 |

91.2 |

49.0 |

1,129.2 |

|

Installed capacity percentage in Dec. (%) |

32.2% |

29.7% |

15.2% |

10.4% |

8.1% |

4.3% |

|

|

In Nov. (MWh) |

346 |

146 |

110 |

77 |

86 |

76.68971 |

842.4 |

|

Installed capacity percentage in Nov. (%) |

41.1% |

17.3% |

13.1% |

9.2% |

10.2% |

9.1% |

|

|

MoM change (%) |

5% |

130% |

55% |

52% |

6% |

-36% |

34.0% |

Sources: Compulsory traffic insurance, Mysteel

The majority of CALB batteries are installed in mini vehicles, and the installed capacity is greatly affected by popular car models.

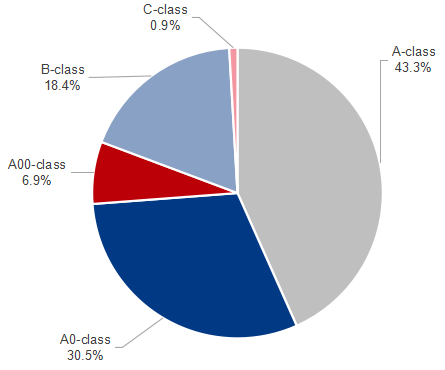

Last December, CALB had batteries installed on 7,377 A-class EVs, accounting for the largest 43.3% in the battery maker's total installed capacity, and on 155 C-class EVs, with the smallest proportion of 0.9%. In terms of specific car models, smart #1 saw the highest sales in December, with 5,000 units being sold and the installed capacity reaching 335.4 MWh. Aion S came in second with 2,561 units being sold and an installed capacity of 150.7 MWh; and Dongfeng Fukang ES600 ranked third with sales of 1,701 units and an installed capacity of 91.2 MWh. At the same time, XPENG P7, Aion V, Changan Benben E-Star, and Leapmotor C11 ranked 4th to 7th respectively. The sales of these seven models all exceeded 1,000 units in December. As shown in Figure 1-2, the combined installation for A- and A00-class EVs accounted for more than 70% of CALB's total battery installation in December. Given the rising sales of Aion S (A-class), smart #1 (A0-class) and other popular car models, it is expected that CALB's batteries will still be mainly installed on mini vehicles in the future.

Figure 1-2: CALB's battery installations on EVs (by class)

Sources: Compulsory traffic insurance, Mysteel

CALB supplies better-performed high-voltage ternary lithium batteries, and its OS technology helps drive up the installed capacity of LFP batteries.

CALB's LFP battery installation reached 22,344 units or 468.6 MWh in December 2022, accounting for 29.3% of the company's total battery installation, with an average charge capacity per vehicle of 21 KWh, while that of ternary lithium batteries was 17,029 units or 1,129.2 MWh, making up 70.7% of the total, with an average charge capacity per vehicle of 66.3 KWh. The difference between the average charge capacity per vehicle of LFP batteries and ternary lithium batteries is mainly because LFP batteries are widely installed in A00-class vehicles while the majority of CALB's LFP batteries is installed in mini EVs, which pulls down the average charge capacity per vehicle of LFP batteries.

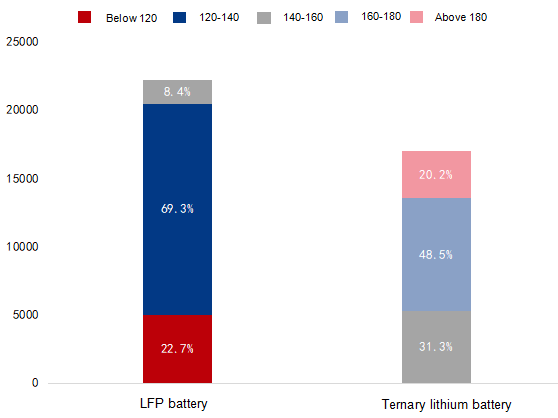

In terms of technologies, CALB takes the lead in adopting the high-voltage technology to produce medium-nickel ternary lithium batteries, a competitive product of the company. At high voltages, the actual energy density of NCM6 series ternary batteries is quite close to that of NCM8 series. The energy density of most installed ternary lithium batteries exceeds 140 Wh/kg, with that of 48.5% batteries falling between 160-180 Wh/kg. Regarding LFP batteries, CALB has developed the One-Stop (OS) battery platform technology, which could drive the energy density of LFP batteries up to 170-190 Wh/kg and support a driving range of over 600 kilometers. However, based on the company's battery installation in December, the energy density of installed LFP batteries was below 160Wh/kg, with 69.3% batteries having energy density between 120-140Wh/kg. Apparently, the OS technology has not been applied on mass-produced car models. But with the release of battery capacity via the OS platform, the company will see its LFP battery installation increase to a certain extent.

Figure 1-3: CALB's battery installation by energy density (Unit: unit)

Sources: Compulsory traffic insurance, Mysteel

The market share of CALB batteries is expected to increase further in response to growing demand from downstream.

Due to multiple factors such as supply chain security and product diversification, automakers are eager to develop two core battery suppliers, which coincides with the customer diversification strategy of CALB. So, CALB has also accelerated capacity expansion to seize the market. The company's current capacity projects include Changzhou phases I-II, Xiamen phase I, and Wuhan phase I. And its Jiangmen phase I project, which mainly produces LFP batteries with the OS platform, is expected to be put into production in the first quarter of this year. CALB has intensively released its production capacity since 2022. At present, its effective production capacity is about 35 GWh, surging 192% from last year. According to the prospectus, CALB's production capacity is anticipated to reach 90 GWh in 2023. It is expected that CALB may keep gaining market share in 2023 and open up a gap on other second-tier battery suppliers.

Table 1-2: CALB's production capacity construction

|

Project |

Planned capacity (GWh) |

Production line status |

|

Changzhou Phase I-III |

45 |

Some production lines of Phase 1 and Phase 2 have been put into operation. |

|

Changzhou Phase IV |

25 |

Under construction |

|

Chengdu Phase I |

20 |

The 10 GWh production line went into trial production in late 2022. |

|

Chengdu Phase II |

30 |

The contract was signed in Sep. 2022 and the project is currently under construction. |

|

Meishan Factory |

20 |

The construction will be completed in Oct. 2022, and it is expected to be put into operation in the first half of this year at the earliest. |

|

Wuhan Phase I |

10 |

Put into production in Sep. 2022 |

|

Wuhan Phase II |

10 |

The core production line has been completed in advance, and the overall capacity has a certain ramp-up period. |

|

Xiamen Factory |

65 |

The third phase was successfully completed, and it is expected to be put into production in the first quarter of this year at the earliest. |

|

Jiangmen Phase I |

25 |

The first production line is expected to be put into operation in March. |

|

Jiangmen Phase II |

25 |

|

|

Guangzhou Factory |

50 |

Adopt the world's latest unique One-stop battery technology. |

|

Total |

325 |

The effective capacity will be about 40 GWh in 2023. |

Source: Mysteel

Written by Mysteel Nonferrous Metal & New Energy Research Center

Edited by Ruby Zhang, zhangjiajing@mysteel.com; Alyssa Ren, rentingting@mysteel.com